To learn more about how does Advance Card billing work, simply click the link below:

- How to view the Unique Reference in-App

- Billing cycle, Due date, and Billing statement

- Repayment allocation logic

- Late Fees (Late Interest and Late Penalty)

- How can I pay my Advance Card Bills?

- What must I include when making a repayment via bank transfer?

- When should I make a repayment if I choose to make a bank transfer?

- Do I still need to pay for my bill if I have already filed a dispute on certain charges?

A. How to view the Unique Reference in-App

You may watch our video guide below or follow the steps towards the end of the article:

Timestamp:

0:00 - How to get the unique reference code from your Aspire app

1:00 - How to get the unique reference code from your Advance Limit Statement

Step-by-step guide

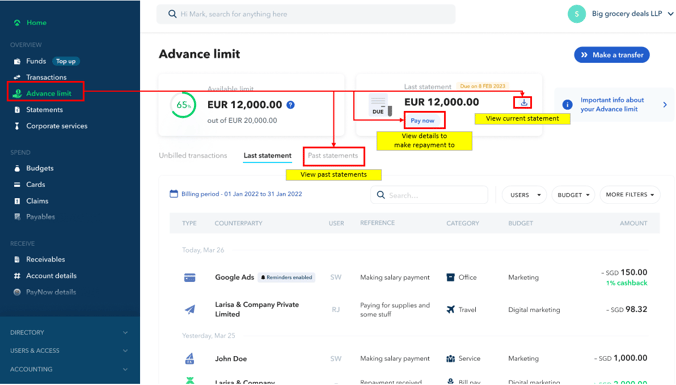

Step 1: Navigate to Advance Tab and choose "Pay now" to see options

Step 1: Navigate to Advance Tab and choose "Pay now" to see options

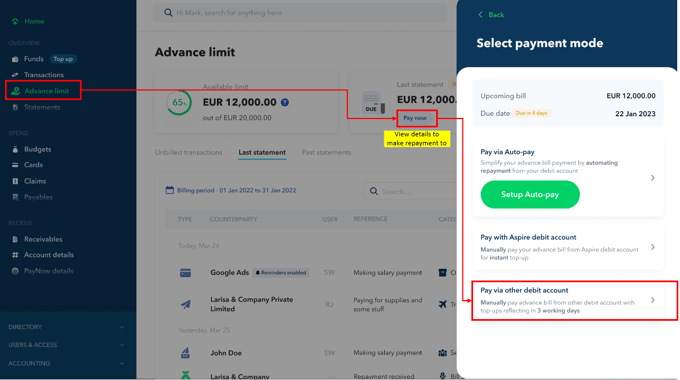

Step 2: Choose "Pay via other debit account" to see your unique repayment reference code in-app

Step 2: Choose "Pay via other debit account" to see your unique repayment reference code in-app

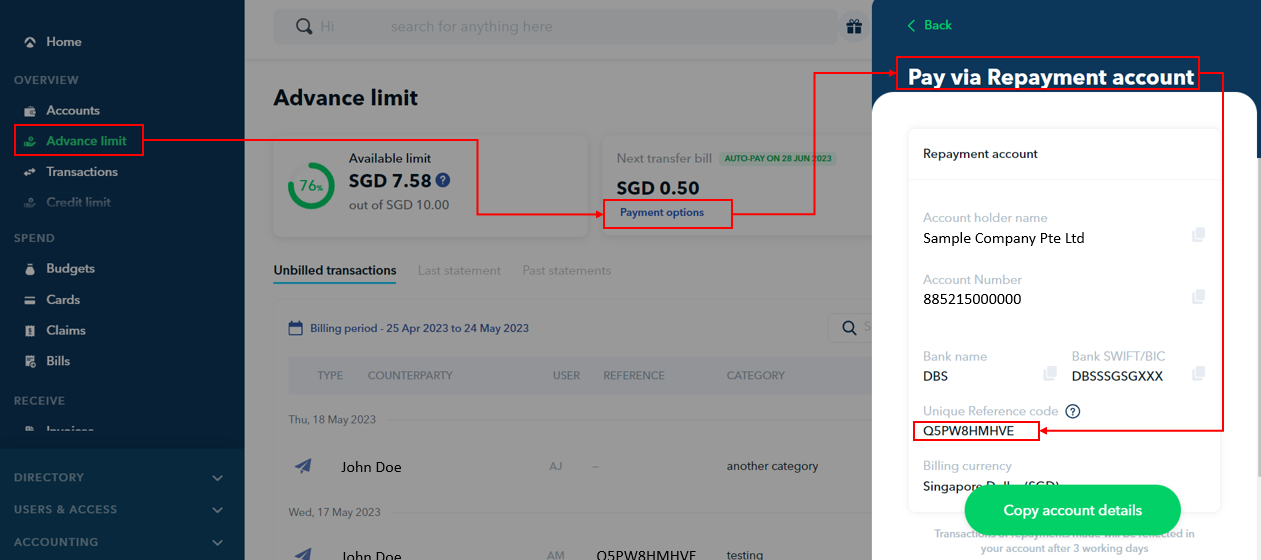

Step 3: Include only this same unique repayment reference code for every bill repayment when making a bank transfer under the comments/remarks section of the transfer.

Your unique repayment reference code does not change per bill issued and remains the same throughout the use of your advance limit with Aspire. You may also use the same unique repayment reference code for early repayments, and over repayments even before your bill's due date.

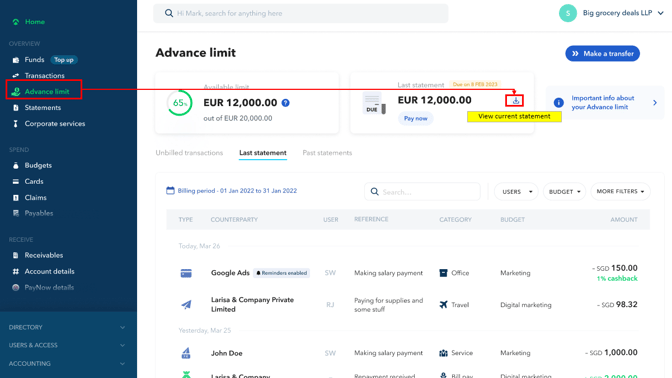

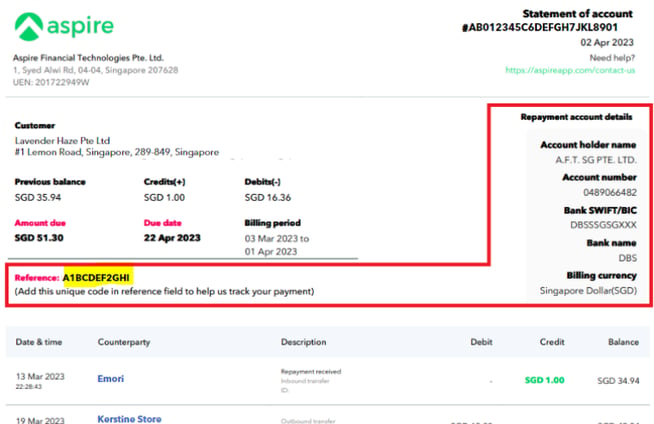

Step 4: If you wish to see the unique repayment reference in your bill, simply download your current bill and view the reference. It will be the exact same reference as what you see in-app, and will be the exact same reference in every single bill, which you must include in your bank transfer when making a repayment. (Image below is for illustrative purposes only)

Step 4: If you wish to see the unique repayment reference in your bill, simply download your current bill and view the reference. It will be the exact same reference as what you see in-app, and will be the exact same reference in every single bill, which you must include in your bank transfer when making a repayment. (Image below is for illustrative purposes only)

B. Billing cycle, Due date, and Billing statement

Your 30-day billing cycle starts on the date of your first transaction and ends 29 days later.

The due date for repayment will be 21 days after the end of the billing cycle.

For example, if your first transaction is on 8 Jun 22:

- Bill 1 Cycle: 8 Jun 22 - 07 Jul 22 | Payment Due date: 28 Jul 22

- Bill 2 Cycle: 8 Jul 22 - 6 Aug 22 | Payment Due date: 27 Aug 22

- Bill 3 Cycle: 7 Aug 22 - 5 Sep 22 | Payment Due date: 26 Sep 22

Bills are automatically sent out one day after the end date of each billing cycle.

For example, if your bill is from 7 Aug 22 - 5 Sep 22, the automated bill will be sent the next day on 6 Sep 22 to admins/finance user roles.

Visit our FAQ to learn how to view your Advance Card billing statement in-app.

Note! Automated bills are only sent out to "admin" or "finance" user roles.

The automated bill will not be sent if you do not have an "admin/finance" user role set up.

Find out how to set your role as an admin/finance user here.

C. Repayment allocation logic

- If you make an overpayment for your Advance Card bill/Advance Transfer bill, the excess will be allocated as a repayment to your current outstanding Advance Card bill, which has been generated.

- If there is no advance card bill with any outstanding amounts, the repayment will be allocated to your advance card bill - for the current billing period.

- Any overpayment will not be allocated to another Advance Transfer bill in any situation.

- A fund transfer return to another account for overpaid/excess funds in your advance account will not be possible unless the advance facility is closed.

- We recommend that if you make a repayment for your Advance Transfer, please pay for the repayment in an exact amount, so we can allocate it to the correct bills (e.g. Your Advance Transfer bill 1 is 10,000 USD, and Advance Transfer bill 2 is 20,000. Do not pay 30,000 USD. Please pay via two separate bills of 10,000 USD and 20,000 USD each).

- Bill 1 - Advance Transfer (generated) Due 10,000 USD

- Bill 2 - Advance Transfer (generated) Due 20,000 USD

- Bill 3 - Advance Card (generated) Due 15,000 USD

- Bill 4 - Advance Card (Not yet generated, Billing cycle still open)

- Bill 1 - Advance Transfer (generated) Due 10,000 USD (Record +10,000 USD out of the 28,000 USD received)

- Bill 2 - Advance Transfer (generated) Due 20,000 USD (skipped)

- Bill 3 - Advance Card (generated) Due 15,000 USD (Record +15,000 USD out of the 28,000 USD received)

- Bill 4 - Advance Card (Not yet generated) (Record +3,000 USD out of the 28,000 USD received)

D. Late Fees (Late Interest and Late Penalty)

Any bill repayments after each billing cycle due date will result in a late fee of 2% late interest on the outstanding amount due, and a 50 USD (or equivalent) charge applied to your existing limit.

These fees are compounded and charged per billing cycle.

Your limit will be frozen, and once the outstanding bill amount has been paid off we will assist to review the unfreezing of your limit.

Note: In the event that inconsistent/undesirable repayment behavior is observed, or there is a change to Aspire's risk policies, Aspire reserves the right to permanently freeze or cancel your limit at any time even after a full repayment has been made.

E. How can I pay my Advance Card Bills?

There are two ways to pay for your Advance Card Bills:

1. Pay using your Aspire SGD, USD or IDR Account

You can automate your Advance Card bill payment using your Aspire SGD, USD or IDR payment! Visit our FAQ to learn how to set this up in your account.

2. Pay via Bank Transfer to our repayment bank details

Your billing statement shows our repayment bank details (visit our FAQ for an example Advance Card billing statement).

Note: For repayments sent via SWIFT there are likely to be bank charges on the sender's end. SWIFT transfers typically involve intermediary/correspondent bank fees that may be deducted from the principal amount when sent under "SHA" charge type. Senders are unable to select the intermediary bank, and this fee varies typically between $7 - $60 USD based on average industry charges, depending on the correspondent banks used by SWIFT network.

For bill repayments via SWIFT, we recommend you to use the "OUR" charge type to ensure no intermediary bank fees are deducted from the full principal amount sent, so that the full amount is received by Aspire and your bills can be marked as repaid in full.

If the full amount is not received by Aspire, your bill will not be marked as fully repaid, and late fees will be applied after the due date along with your limit being frozen.

F. What must I include when making a repayment via bank transfer?

There are two ways to pay for your Advance Card Bills: if you choose NOT TO automate your Advance Card bill payment using your Aspire SGD, USD or IDR payment (FAQ), and still wish to proceed with a monthly bank transfer, you MUST include the unique REFERENCE number in your transfer (comments/ notes/ reference) field if available.

This will help us to quickly identify your payment and match it to the correct advance limit account it is meant for.

- Failure to do this may result in a delay in recording repayments to your account, where your account may be frozen until we are able to identify that the funds received are meant for your advance limit account and refresh the limit.

- The REFERENCE is unique to your advance account per currency, and does not vary for each monthly bill issued. Thus, the exact same REFERENCE can be used in every bill repayment/early repayment per advance limit account.

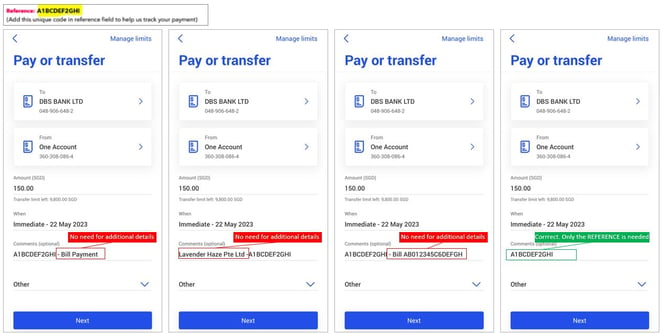

Other than the REFERENCE, there is no need to add additional details as a prefix/or postfix.

Sample Bank Transfer Screen

- "A1BCDEF2GHI - Bill Payment"

- "Lavender Haze Pte. Ltd. -A1BCDEF2GHI"

- "A1BCDEF2GHI - Bill AB012345C6DEFGH"

- "A1BCDEF2GHI"

G. When should I make a repayment if I choose to make a bank transfer?

We recommend for you to make the Bill repayment at least 5 business days before the Due date to ensure that funds are received on time for Aspire to refresh your limit.

A SWIFT transfer typically takes 3-5 business days to be received, and we are unable to refresh your credit limit until the funds have been received by Aspire (even if a transfer proof/screenshot is provided).

H. Do I still need to pay for my bill if I have already filed a dispute on certain charges?

You will still be required to pay the full outstanding amount on your bill, even if you have filed for disputes on certain transactions. Failure to pay the full outstanding bill (including the disputed spend amounts) will result in a freeze of your advance limit by the due dates, along with late fees.

Once the dispute result has been concluded (if your dispute is successful) the funds will be returned to your charge account.

Please refer to this FAQ on what to do if you see an unauthorized transaction on your account.

Here are some FAQs you may find helpful:

- Where can I view my Advance Limit details?

- How can I view my Advance Card Invoice/Statement?

- Can I make an early repayment for my Advance card bill?

Questions? Reach out in the chat at the bottom right corner of the screen.

Suggestions? Let us know here.