Here are some practical steps you can take to protect your account from any fraud and unauthorized access.

To quickly access the section of the FAQ you're looking for, simply click on the links below.

Turn on notifications for all transactions

Head to Settings > Notifications > Turn on notifications for all transfers and card payments.

You can also customize delivery options and choose to receive notifications via Email, SMS or Push notifications. We highly recommend that you to download the Aspire mobile app to receive real-time push notifications.

Notes:

- OTP requirements are enforced by the merchants themselves. Therefore, if your merchant does not require OTP, some transactions can be deducted without verification. Transact with reputable merchants and turn on notifications for all transactions and cards to be alert of suspicious transactions promptly.

- OTP codes won't be triggered for transactions made using IDR cards issued by Mastercard

Admin users

For Admin users, you have the option to enable notifications for various activities related to Transfers and Cards:

-

Outbound transfers

-

Inbound transfers

-

Transfer approval

-

Low balance reminder

-

Card transaction

-

Card cashback

Finance Users

For Finance users, you have the option to enable notifications for various activities related to Transfers and Cards:

-

Outbound transfers

-

Inbound transfers

-

Transfer approval

-

Low balance reminder

-

Card transaction

Employee users

For Employee users, you can only enable notifications for card transactions.

Add card merchant locks

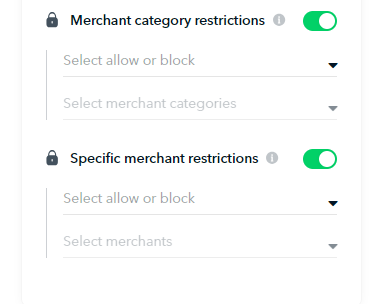

Limit card payments to only the category of merchants and specific merchants you trust. For any new or existing cards, click on Edit > Add Merchant Category Restrictions and Specific Merchant restrictions. Select only merchants you want to spend with.

With merchant locks, you can have the peace of mind that no card transactions will be made with unknown merchants.

Add card spending limits or assign cards to budgets

You can also enforce spend controls for each card or a group of cards. Simply head to Card > Edit > Switch on Spend limit or add card to Budget.

You can adjust the spend limit amount and frequency. You’ll also be alerted whenever you’ve reached spend limits.

Update your devices, browsers and apps updated

Update your devices’ operating systems frequently to be protected by the latest security patches. Always use the latest version of your Aspire app so your account’s always protected with the best security settings.

Don’t click on suspicious links

Stay vigilant and avoid clicking on suspicious links or downloading applications from unknown sources. Always reach out to Aspire if you have any doubts.

Never share sensitive information such as OTPs and card details.

Please do not share sensitive information such as OTPs, login and card details. Aspire will never request such information from our customers.

Aspire will always refer to your ticket number and will never send you a link over SMS.

Please notify us if there are any parties requesting this information. Implement 2-factor authentication for both your email and Aspire accounts. Use distinct passwords across various accounts, avoiding password sharing. It's advisable to update your passwords regularly.

Your account security is of utmost importance to us. You can also play a part in helping to fight against malicious attacks. Please contact us when you notice any suspicious activities on your account. This will help us improve our onboarding security monitor efforts, and stop any fraudulent activities with immediate action.

Thank you for your trust and continued business with Aspire.

Questions? Please log in to the app and reach out in the chat at the bottom right corner of the screen.

Suggestions? Let us know here.